Your credit score plays a significant role in your financial life. Whether you’re applying for a mortgage, a car loan, or even a new credit card, lenders use your credit score to assess your financial health and determine how much risk they are taking on by lending you money. A higher credit score generally means better interest rates, loan approvals, and favorable terms. Conversely, a low credit score can limit your financial opportunities and cost you more in interest over time.

If your credit score isn’t where you’d like it to be, the good news is that you can improve it. While boosting your credit score isn’t an overnight process, there are steps you can take to see noticeable improvements in a relatively short amount of time. In this guide, we’ll walk you through proven strategies to improve your credit score quickly and easily.

Understanding Your Credit Score

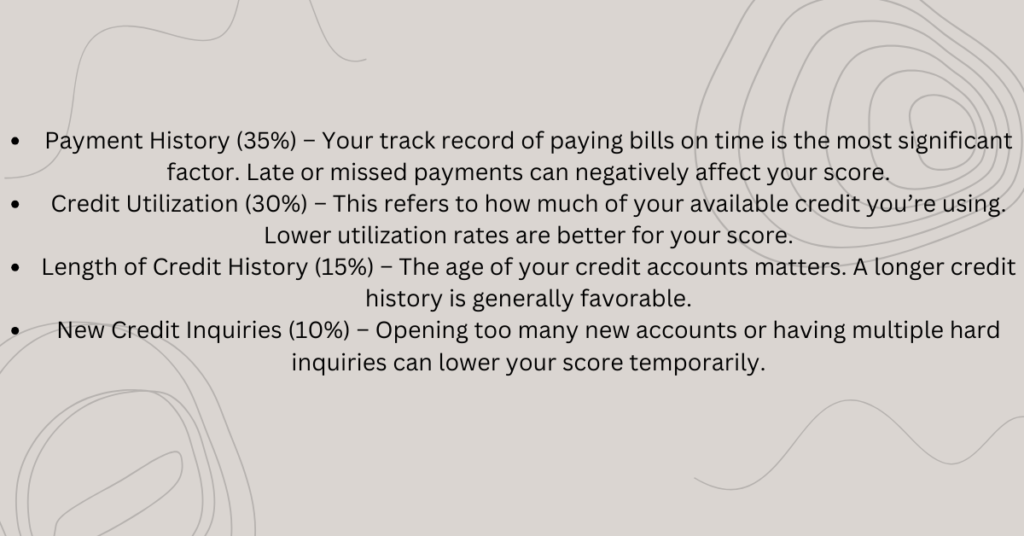

Before diving into how to improve your credit score, it’s essential to understand what factors contribute to it. Credit scores are calculated based on the following five key factors:

With this foundation in mind, let’s explore practical ways to improve your credit score.

1. Pay Bills on Time, Every Time

Your payment history is the single most important factor in determining your credit score. Late or missed payments can significantly hurt your score, especially if they go beyond 30 days. Fortunately, this also means that paying your bills on time consistently is one of the fastest ways to boost your credit score.

How to Make Timely Payments:

- Set reminders or automate payments: Use calendar alerts, reminders, or automate payments for recurring bills such as utilities, rent, or credit card minimums.

- Focus on all accounts: Ensure you’re paying not only your credit cards but also any loans, utilities, and even small payments like medical bills or library fines.

Quick Tip:

If you’ve missed a payment, catch up as soon as possible. The longer a bill goes unpaid, the more damage it will do to your score. If you’re within a 30-day window, paying it before it hits that mark may prevent it from appearing on your credit report.

2. Reduce Your Credit Card Balances

Credit utilization, or the amount of available credit you’re using, is the second most influential factor in your credit score. Ideally, you want to keep your credit utilization below 30% on each credit card and across all of your credit accounts. Lower is better, and anything under 10% is considered excellent.

How to Reduce Credit Utilization:

- Pay down credit card balances: Prioritize paying off high-interest debt and credit cards with balances close to their limits.

- Request a credit limit increase: If your credit is in good standing, consider asking your credit card issuer for a credit limit increase. This increases your overall credit available, which can help lower your utilization rate—just be careful not to rack up more debt.

- Distribute balances across cards: If you have high balances on one or two cards, consider transferring some of that debt to other cards with lower balances to keep your utilization evenly distributed.

Quick Tip:

Be mindful of timing when paying your credit card bill. Your credit utilization is often reported to credit bureaus when your statement is issued, so paying off a portion of your balance before the statement date can help lower your reported utilization.

3. Correct Credit Report Errors

Errors on your credit report can unfairly lower your score, and correcting them can result in a quick credit boost. These errors might include incorrect account information, false late payments, or accounts that don’t belong to you. Checking your credit report regularly for mistakes and disputing any inaccuracies is an essential step in improving your credit score.

How to Dispute Errors:

- Request a free credit report: You’re entitled to a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once every 12 months through AnnualCreditReport.com.

- Review the report carefully: Look for errors such as incorrect account balances, payment history issues, or accounts you don’t recognize.

- Dispute any inaccuracies: If you find an error, you can file a dispute with the credit bureau online. The credit bureau is required to investigate and correct any inaccuracies within 30 days.

Quick Tip:

While disputes are under investigation, your credit report will indicate that the item is being reviewed, which may help prevent lenders from holding the error against you in the meantime.

4. Avoid Opening New Credit Accounts Unnecessarily

Opening new credit accounts can lower your credit score temporarily due to the hard inquiries associated with the application process. Additionally, opening several new accounts in a short period can shorten the average age of your credit history, another factor that can lower your score.

How to Manage New Credit Inquiries:

- Limit hard inquiries: Try to avoid applying for new credit unless it’s absolutely necessary. Multiple inquiries in a short time can raise red flags for lenders and hurt your score.

- Shop smart for loans: If you’re shopping for a car loan or mortgage, credit scoring models typically allow for multiple inquiries from the same type of lender within a 14-45 day period to count as one inquiry. This way, you can compare rates without damaging your score.

Quick Tip:

Check if a lender offers pre-qualification or pre-approval without a hard inquiry. This gives you an idea of whether you’re likely to be approved without affecting your credit score.

5. Keep Old Accounts Open

The length of your credit history accounts for 15% of your credit score. Even if you’re no longer using an old credit card, keeping the account open (assuming it doesn’t have an annual fee) can positively impact your score by increasing the average age of your accounts and improving your credit utilization ratio.

How to Handle Old Accounts:

- Don’t close unused accounts: As long as you’re not paying fees on old credit cards, keep them open. Closing them can shorten the length of your credit history and increase your credit utilization ratio.

- Use old accounts occasionally: To keep an old card from being closed due to inactivity, consider making a small purchase every few months and paying it off in full. This keeps the account active and in good standing.

Quick Tip:

If you have an old account with unfavorable terms (e.g., high interest rates), you can call the credit card company to see if they can offer you better terms or product transfer options.

6. Diversify Your Credit Mix

Having a variety of credit types can improve your score, as it shows lenders you can manage different forms of credit responsibly. If you only have credit card debt, consider adding an installment loan like an auto loan, mortgage, or personal loan to diversify your credit mix. This accounts for 10% of your credit score.

How to Diversify Credit:

- Consider a credit-builder loan: If you don’t have a mix of credit types, a credit-builder loan from a credit union or online lender can help you build credit without taking on significant risk.

- Installment loans: These include mortgages, auto loans, and personal loans. If you’re considering financing a purchase, adding an installment loan to your credit report can enhance your credit mix.

Quick Tip:

Only take on new credit if it makes financial sense for your situation. Don’t open a new account just to diversify your credit if it will put unnecessary strain on your finances.

7. Negotiate and Pay Off Old Debts

If you have delinquent accounts or outstanding debts, resolving them can help improve your credit score. While paying off old debts won’t remove the negative history immediately, it can stop further damage and start the process of rebuilding your credit.

How to Handle Old Debts:

- Negotiate with creditors: If you have accounts in collections, consider negotiating a settlement with the creditor. In some cases, they may be willing to accept a lower payment in exchange for closing the account.

- Request “pay for delete”: When negotiating a debt settlement, ask the creditor if they’re willing to remove the negative information from your credit report in exchange for payment.

- Make consistent payments: If you can’t settle the debt, make a payment plan and stick to it. Consistently paying down debt can demonstrate responsibility and improve your score over time.

Quick Tip:

Even if you’re only able to pay a small amount, it’s better than ignoring the debt. Lenders are often more willing to work with you if you’re making an effort to pay off what you owe.

8. Become an Authorized User

If you have a family member or close friend with good credit, becoming an authorized user on their account can help improve your score. As an authorized user, their account history is added to your credit report, and their responsible credit habits can have a positive impact on your score.

How to Benefit as an Authorized User:

- Choose someone with good credit: Ensure the primary account holder has a strong credit history and low credit utilization.

- No need to use the card: You don’t needto use the card or even have access to it to benefit from being an authorized user. Simply being listed on the account will add the credit history to your report, helping improve your score.

- Quick Tip:

- Make sure the primary account holder continues to manage their account responsibly. Late payments or high credit utilization on their part could negatively affect your credit score.

- 9. Use a Credit-Builder Loan or Secured Credit Card

- If you have limited or poor credit history, a credit-builder loan or a secured credit card can be a valuable tool for improving your score. These financial products are specifically designed for individuals looking to build or repair their credit.

- How to Use a Credit-Builder Loan:

- Credit-builder loans: These are small loans offered by credit unions or online lenders. The money you borrow is held in a savings account while you make monthly payments, and once you’ve paid off the loan, you receive the funds. The lender reports your payment history to the credit bureaus, which can improve your score over time.

- How to Use a Secured Credit Card:

- Secured credit cards: These require a cash deposit as collateral, and your credit limit is usually equal to the amount of the deposit. Use the card for small purchases and pay the balance in full each month to build positive credit history.

- Quick Tip:

- Both of these tools can help establish a solid credit history, but be sure to make all payments on time. Missing payments will have the opposite effect, damaging your score further.

- 10. Set Up Payment Reminders or Automate Payments

- A busy schedule or simple forgetfulness can lead to missed or late payments, which hurt your credit score. Setting up payment reminders or automating your payments is an easy way to ensure that you never miss a due date.

- How to Set Up Reminders:

- Calendar alerts: Use your phone’s calendar app to set alerts a few days before your bill due dates.

- Payment apps: Many credit cards and financial institutions allow you to set up email or text notifications for upcoming payments.

- How to Automate Payments:

- Automatic bill pay: Most banks and credit card issuers offer an automatic payment option. Set this up for at least the minimum payment, so you never miss a deadline.

- Quick Tip:

- If you’re automating payments, make sure there’s enough money in your bank account to cover them to avoid overdraft fees or bounced payments.

- How Long Does It Take to Improve Your Credit Score?

- The time it takes to see improvements in your credit score depends on your starting point and the actions you take. Some strategies, like disputing errors on your credit report or paying down high balances, can result in relatively quick changes to your score within a few months. Other actions, like building a long history of on-time payments, will have a more gradual impact.

- On average, you may see noticeable improvements in your credit score within three to six months of implementing these strategies. The key is consistency—continue to practice good credit habits, and your score will improve over time.

- Final Thoughts: Stay Committed to Long-Term Success

- Improving your credit score quickly and easily is possible with the right approach. By paying bills on time, reducing credit card balances, correcting errors, and managing credit responsibly, you can see tangible results in a relatively short period.

- However, it’s essential to remember that building and maintaining a good credit score requires long-term commitment. Continue to monitor your credit regularly, adjust your habits as needed, and make informed financial decisions to keep your score healthy for the long haul.

- With patience, persistence, and the tips outlined in this guide, you can boost your credit score and unlock better financial opportunities for the future.